India’s roads are about to get a major upgrade. While you might think self-driving cars are still science fiction, Indian startups are already making it happen right here, right now.

The autonomous mobility revolution in India is picking up serious speed.

We’re not just talking about fancy cars that park themselves.

Indian startups are building everything from AI-powered safety systems for motorcycles to fully autonomous trucks for warehouses.

What makes India special? Our roads are the ultimate testing ground.

If your self-driving tech can handle Indian traffic, it can handle anything in the world.

That’s exactly what these startups are betting on.

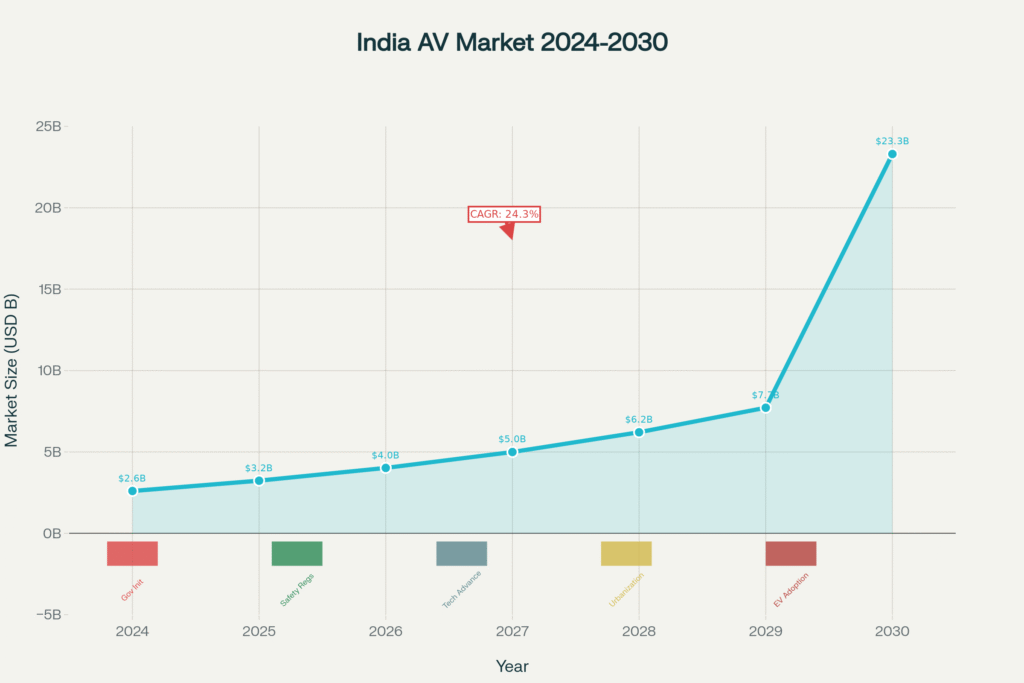

The numbers tell the story. India’s autonomous vehicle market is worth ₹21,000 crores today and is expected to reach ₹1.9 lakh crores by 2030.

That’s massive growth driven by government support, safety concerns, and technology breakthroughs.

But here’s the real kicker – Indian startups aren’t just copying Western solutions.

They’re building from scratch, creating technology that works for our unique conditions.

From camera-only systems that cost 70% less than traditional setups to AI that learns from every autorickshaw and delivery bike on the road.

Ready to meet the companies that are reshaping how we move? Let’s dive into India’s most promising autonomous mobility startups that are turning transportation dreams into reality.

India Autonomous Vehicle Market Growth Projection (2024-2030)

Market Overview & Growth Potential

India’s autonomous vehicle market is experiencing explosive growth that’s impossible to ignore.

The market size jumped from ₹17,000 crores in 2023 to ₹21,000 crores in 2024, and experts predict it’ll reach ₹1.9 lakh crores by 2030.

That’s a mind-blowing 24.3% annual growth rate.

To put this in perspective, India is becoming one of the fastest-growing autonomous vehicle markets globally, even faster than many developed countries.

What’s driving this growth?

Government policies are playing a huge role.

The Motor Vehicles Amendment Act 2019 now allows autonomous vehicle testing on Indian roads.

The government has also pledged ₹5,000 crores to encourage autonomous EV adoption through R&D subsidies and reduced import duties on AV components.

Safety is another massive driver.

India records over 1.68 lakh road accident deaths annually, with 90% caused by human error.

Autonomous vehicles could potentially reduce accidents by up to 90%, making them crucial for saving lives.

The technology infrastructure is also improving rapidly.

5G networks are expanding, AI chips are getting cheaper and more powerful, and India’s software engineering talent is solving problems that Western companies can’t crack.

Key market segments showing promise:

Commercial vehicles are leading the charge.

Companies like Ashok Leyland are partnering with startups for autonomous trucking solutions in ports and factories.

The logistics sector sees immediate value in reducing driver costs and improving safety.

Two-wheeler ADAS is another hot segment.

With over 2 crore two-wheelers sold annually in India, startups like BYTES are building AI safety systems specifically for bikes and scooters.

Industrial applications are gaining traction too.

Warehouses, mines, and construction sites are perfect testing grounds for autonomous vehicles before they hit public roads.

The timing couldn’t be better.

Global supply chain disruptions have made “Made in India” autonomous tech more attractive, while rising fuel costs make electric autonomous vehicles economically viable.

Government Initiatives & Policy Support

The Indian government is actively creating an ecosystem that supports autonomous vehicle development.

This isn’t just talk—there are real policies and serious money backing this transformation.

Motor Vehicles Amendment Act 2019

The biggest game-changer has been the Motor Vehicles Amendment Act 2019.

This legislation specifically allows testing of autonomous vehicles on Indian roads under controlled conditions.

Before this, there was no legal framework for even testing self-driving cars.

The Act also mandates automated vehicle fitness testing, which creates the foundation for autonomous vehicle certification.

FAME-II Scheme Integration

The FAME-II (Faster Adoption and Manufacturing of Electric Vehicles) scheme has allocated ₹10,000 crores over five years to promote electric vehicle adoption.

While primarily focused on EVs, the scheme supports autonomous electric vehicles through demand incentives and charging infrastructure development.

Since 2019, FAME-II has supported over 16 lakh electric vehicles and 8,885 charging stations.

The synergy between electric and autonomous vehicles makes this support crucial for startups developing autonomous EVs.

Bharat NCAP and Safety Standards

Bharat NCAP, launched in October 2023, is revolutionizing vehicle safety standards in India.

The upcoming Bharat NCAP 2.0 will specifically evaluate ADAS (Advanced Driver Assistance Systems) capabilities, making safety tech mandatory for higher ratings.

This creates a regulatory push for autonomous safety features even in conventional vehicles.

According to Ujjwala Karle from ARAI, “ADAS features will be tailored for Indian road conditions, where unique challenges such as mixed traffic and erratic driving behavior need special attention.”

Smart Cities Mission Support

The government has allocated approximately $1.5 billion to develop 100 smart cities, with 60 already participating in intelligent transportation initiatives.

This creates perfect testing environments for autonomous vehicles in controlled urban settings.

R&D and Innovation Support

The government provides R&D subsidies and reduced import duties on autonomous vehicle components.

Multiple state governments, especially Karnataka and Telangana, offer additional incentives for autonomous vehicle startups.

The challenge remains in creating comprehensive commercial deployment regulations.

While testing is allowed, there’s still regulatory uncertainty around liability, insurance, and full commercial operations.

Leading Indian Autonomous Vehicle Startups

Let’s meet the game-changers who are putting India on the global autonomous vehicle map.

These aren’t just startups with big dreams—they’re companies with real technology, actual funding, and working prototypes.

1. Swaayatt Robots—The Level 5 Pioneer

Founded: 2015 | Location: Bhopal, MP | Funding: $4 million

Swaayatt Robots made global headlines when they claimed to achieve the world’s first Level 5 autonomous driving system.

While Tesla is still stuck at Level 2, this Bhopal-based startup demonstrated their self-driving Mahindra Bolero navigating through busy toll plazas and chaotic streets.

What sets them apart? Their approach is purely mathematical and probabilistic, reducing dependence on expensive sensors like LiDAR.

Instead, they use sparse maps and AI algorithms that can handle India’s unpredictable traffic patterns.

The company has conducted over 80 demonstrations and claims their technology works for both on-road and off-road driving – crucial for military applications.

They’re targeting global OEMs and planning to license their technology worldwide by 2030.

Recent milestone: Secured $4 million funding in 2024 at a $151 million valuation after viral demonstrations of their autonomous vehicle.

2. Minus Zero – The AI-First Approach

Founded: 2021 | Location: Bengaluru, Karnataka | Funding: $1.8 million

Minus Zero is taking a completely different approach with their “Nature-inspired AI” technology.

Instead of relying on high-definition maps or rule-based systems, they use foundational AI models that learn from massive amounts of unstructured driving data.

Their breakthrough came in May 2025 when they launched India’s first end-to-end AI-powered autopilot system.

Unlike traditional systems, theirs works with just cameras – no expensive LiDAR required.

The magic happens through their foundational models, similar to ChatGPT but designed for real-world navigation.

These models can handle unique Indian obstacles like cattle, push-carts, and erratic two-wheelers that would confuse Western autonomous systems.

According to industry expert analysis, “Minus Zero’s focus on the unique complexity of driving in emerging markets sets it apart. Unlike most Western geographies, countries like India present far more ‘long-tail’ scenarios”.

Big partnership: Signed a strategic alliance with Ashok Leyland to develop autonomous trucking solutions for ports, factories, and corporate campuses.

3. Flux Auto – The Universal Platform

Founded: 2016 | Location: Bengaluru, Karnataka | Funding: $6+ million

Flux Auto is solving a different problem – instead of building new vehicles, they retrofit existing ones with autonomous capabilities.

Their “Odin” platform can turn any truck, tractor, or industrial vehicle into an autonomous machine.

This approach is brilliant for cost-conscious markets like India.

Instead of replacing entire fleets, companies can upgrade their existing vehicles for a fraction of the cost.

Flux focuses on controlled environments like warehouses, farms, and mines where regulations are simpler and the ROI is immediate.

They’ve successfully deployed autonomous solutions across the US, India, and Mexico.

Y Combinator connection: They’re backed by Y Combinator and have established operations in Houston, Texas, showing their global ambitions.

4. Flo Mobility – The Material Movement Specialists

Founded: 2020 | Location: Bengaluru, Karnataka | Focus: Construction & Industrial

Flo Mobility is tackling a specific but huge problem – autonomous material movement in construction, agriculture, mining, and warehousing.

Their FLO Hauler robots are already being used by industry leaders like L&T, PSP, and Total Environment.

What’s smart about their approach is the Robot-as-a-Service (RaaS) model.

Customers don’t need to buy expensive robots upfront – they can rent them, making adoption much easier for smaller companies.

The company claims 50% savings on cost and time for last-mile material movement, which is a compelling value proposition for labor-intensive industries.

Partnership power: They’ve partnered with Zypp Electric to build autonomous delivery bots for the Delhi-NCR region.

5. BYTES – The Two-Wheeler Guardian

Founded: 2024 | Location: India | Funding: ₹1 crore (grants)

BYTES is solving a uniquely Indian problem – making two-wheelers safer through AI-powered Advanced Driver Assistance Systems (ADAS).

With over 2 crore two-wheelers on Indian roads, this is a massive market opportunity.

Founded by former Minus Zero employees Aayush Kumar and Prakhar Agrawal, BYTES spent 28 days on Indian roads studying accident patterns.

They identified 10 major causes including blind spots, forward collisions, and highway fatigue.

Their AI system provides real-time alerts to riders about potential dangers, effectively working as a “guardian angel” for bikers.

The technology is being piloted with 6 OEMs and 15 more have expressed interest.

Unique positioning: They’re targeting the massive gig economy with subscription models as low as ₹10-15 per day for fleet riders.

6. Drivomate – The Vision-Based ADAS

Founded: 2024 | Location: India | Focus: 2&4 Wheeler ADAS

Drivomate is building AI-powered ADAS technology specifically tailored for India’s complex road conditions.

Their vision-based system can identify lane drift even on damaged or missing road markings – a common problem on Indian roads.

The startup uses AI-driven motion tracking, pixel-to-real-world mapping, and dynamic region detection to provide real-time alerts for crosswind avoidance, speed prediction, and rash driver detection.

What makes them special is their focus on entry-level vehicles and two-wheelers, bringing safety technology to the mass market at affordable prices.

7. Flow Pilot – The Open Source Solution

Founded: 2021 | Location: Bengaluru, Karnataka | Model: Open source

Flow Pilot started as a college project and evolved into India’s first open-source ADAS system.

Built on top of openpilot (US-based software), they’ve collected over 1 lakh miles of Indian driving data.

Their system runs on low-powered devices like Android phones, making it incredibly accessible.

A viral video showed their system controlling an Alto car using just a Redmi Note 9 Pro.

The beauty of their approach is affordability and Indian-specific optimization.

Unlike expensive systems from companies like Mobileye, Flow Pilot is designed for Indian road conditions and budget constraints.

8. Ati Motors – The Industrial Robotics Leader

Founded: 2017 | Location: Bengaluru, Karnataka | Funding: $20 million (Series B)

While not strictly autonomous vehicles, Ati Motors deserves mention for their AI-powered industrial robots that move materials autonomously in factories and warehouses.

Their Sherpa robots can transport up to 1000 kg payloads.

The company recently raised $20 million in Series B funding and is expanding globally with operations in Mexico and a headquarters in Detroit, Michigan.

Scale achievement: 18+ customers using their robots across 31 factory plants, showing real commercial traction.

9. Tata Elxsi – The Automotive Design Powerhouse

Founded: 1989 | Location: Bengaluru, Karnataka | Status: Public company

Tata Elxsi isn’t a startup in the traditional sense, but they’re a major player in India’s autonomous vehicle ecosystem.

They provide end-to-end automotive design and technology services, including ADAS development, connected vehicle solutions, and autonomous driving software.

Their expertise spans across the entire automotive value chain – from concept design to production-ready systems.

They work with global OEMs and Tier-1 suppliers to develop next-generation mobility solutions.

Key strength: Deep automotive domain expertise combined with cutting-edge technology capabilities in AI, machine learning, and embedded systems.

10. KPIT Technologies – The Software Solutions Expert

Founded: 1990 | Location: Pune, Maharashtra | Status: Public company

KPIT Technologies is a global leader in automotive software solutions with significant focus on autonomous driving technologies.

They provide software integration, middleware, and embedded solutions for automotive OEMs worldwide.

Their autonomous vehicle portfolio includes sensor fusion algorithms, perception software, and validation tools.

KPIT has partnerships with major global automotive companies and is actively involved in developing India-specific autonomous solutions.

Global reach: They work with 25+ automotive OEMs across North America, Europe, and Asia-Pacific regions.

11. Carvia Technologies – The ML/DL Specialists

Founded: 2020 | Location: Sahibzada Ajit Singh Nagar | Focus: Machine Learning & Deep Learning

Carvia Technologies focuses on applying advanced machine learning and deep learning techniques to solve autonomous vehicle challenges.

They specialize in computer vision, sensor fusion, and AI-powered decision-making systems for automotive applications.

The company is developing proprietary algorithms for object detection, path planning, and behavioral prediction specifically tuned for Indian traffic conditions.

Technology focus: End-to-end software development with emphasis on AI/ML model optimization for resource-constrained automotive environments.

12. Aspire Aviation – The AI & LiDAR Innovators

Founded: 2021 | Location: Bengaluru, Karnataka | Focus: Autonomous Systems with AI & LiDAR

Aspire Aviation is developing advanced surveillance and monitoring systems using AI and LiDAR technology.

While their primary focus is on aviation and defense applications, their autonomous systems technology has significant crossover potential for ground vehicles.

They’re working on advanced sensor fusion techniques that combine AI-powered computer vision with LiDAR data processing for real-time autonomous decision-making.

Unique positioning: Their experience in aviation autonomous systems brings a different perspective to ground vehicle autonomy, especially in areas like obstacle avoidance and path planning.

Technology Focus Areas & Innovation

Indian autonomous mobility startups are taking unique approaches that differ significantly from their global counterparts.

Understanding these technology focus areas helps explain why Indian solutions might actually work better worldwide.

Vision-First Approach Dominates

Most Indian startups are adopting camera-first solutions instead of expensive LiDAR systems.

Companies like Minus Zero and Drivomate prove that advanced AI can achieve similar results with just cameras and radar, reducing costs by up to 70%.

This isn’t just about saving money.

Indian roads often lack proper lane markings, have unpredictable obstacles, and feature mixed traffic that LiDAR systems struggle to interpret.

Vision-based AI, trained on Indian data, handles these “corner cases” much better.

As Jensen Huang, CEO of Nvidia, famously said: “If somebody can conquer autonomous driving in India, you can be assured that autonomous driving will be solved everywhere else in the world. In India, people drive by sound and not by sight”.

AI-Native Architecture Revolution

Instead of rule-based programming, Indian startups are building foundational AI models that learn and adapt.

Minus Zero’s “Nature-inspired AI” and Swaayatt’s probabilistic approach represent a fundamental shift in how autonomous systems think.

These AI models don’t just follow predetermined rules – they understand context and make judgment calls like human drivers.

This is crucial for navigating India’s chaotic traffic where following traffic rules rigidly would actually cause accidents.

Retrofit Solutions for Cost-Conscious Markets

Companies like Flux Auto are focusing on retrofitting existing vehicles rather than building new ones.

This approach makes commercial sense in cost-sensitive markets and allows faster deployment without waiting for new vehicle purchases.

Application-Specific Development Strategy

Rather than trying to solve everything at once, Indian startups are targeting specific use cases:

- Industrial material movement (Flo Mobility)

- Two-wheeler safety (BYTES)

- Controlled environments (Flux Auto)

This focused approach allows faster development and clearer ROI.

Regional Analysis & Startup Hubs

Bengaluru: The Undisputed Capital

Bengaluru dominates India’s autonomous mobility landscape with 7 out of 12 major startups based there.

The city’s advantages include:

- Established tech ecosystem with global R&D centers

- Access to AI/ML talent from top institutions like IISc

- Proximity to automotive OEMs and suppliers

- Government support through Karnataka’s IT policy

Companies like Minus Zero, Flux Auto, and Flo Mobility benefit from Bengaluru’s collaborative startup environment and access to international investors.

Emerging Regional Players

While Bengaluru leads, other regions are making their mark:

- Bhopal, MP: Home to Swaayatt Robots, proving that innovation isn’t limited to traditional tech hubs

- Pune, Maharashtra: KPIT Technologies leverages the city’s automotive manufacturing base

- Punjab: Carvia Technologies represents emerging talent from tier-2 cities

This geographic diversity shows that autonomous vehicle innovation is spreading across India, not just concentrated in a few metros.

Funding Landscape & Investment Trends

The funding scenario for Indian autonomous mobility startups is heating up, with both domestic and international investors showing serious interest.

Investment Momentum Building

Total funding in Indian autonomous vehicle startups has crossed $35 million in 2024-25, with major rounds including:

- Ati Motors: $20 million Series B

- Flux Auto: $6+ million

- Swaayatt Robots: $4 million

- Minus Zero: $1.8 million

Government Financial Support

The Indian government has allocated ₹5,000 crores for autonomous EV development through R&D subsidies and reduced import duties.

Programs like FAME-II (₹10,000 crores total) and the National Logistics Policy are creating a supportive ecosystem.

Investor Interest Growing

Venture capitalists are particularly interested in Indian autonomous tech because of its global scalability potential.

If technology works in India’s challenging conditions, it can work anywhere.

Notable investors include:

- Chiratae Ventures (backing Minus Zero)

- Y Combinator (Flux Auto)

- Walden Catalyst Ventures (Ati Motors)

Valuation Trends

Swaayatt Robots achieved a $151 million valuation in 2024, showing that investors believe in Indian autonomous tech potential.

However, most startups are still in early stages with valuations reflecting their technology potential rather than revenue.

The funding is increasingly shifting from pure research to commercial deployment, indicating the market is maturing from proof-of-concept to real-world applications.

Challenges & Opportunities Matrix

Indian autonomous mobility startups face unique challenges but also have unprecedented opportunities that could make them global leaders.

Challenges vs Opportunities Matrix for Autonomous Vehicles in India

Infrastructure & Technical Challenges

Poor road conditions create both problems and opportunities.

While unmarked lanes and mixed traffic are challenges, they’re also forcing Indian startups to develop more robust solutions.

According to Rajat Mahajan from Deloitte: “India’s traffic discipline, inconsistent road signages, traffic signals, and road geometry are challenges. Before we think of introducing automation on Indian roads, these need to be addressed”.

Regulatory Framework Evolution

While the Motor Vehicles Amendment Act 2019 allows testing, commercial deployment regulations are still evolving.

Union Minister Nitin Gadkari has expressed concerns about job displacement, stating he won’t allow driverless cars that threaten employment.

However, the regulatory sandbox approach is gaining support for controlled environment deployments.

Cost Sensitivity Driving Innovation

India’s price-sensitive market is actually driving breakthrough innovations.

As Srihari Mulgund from EY Parthenon explains: “For India, the real tipping point will be the economics of automation. The moment salaries rise to ₹30,000-₹50,000 per month, businesses will seriously consider autonomous options”.

Global Export Opportunities

The biggest opportunity lies in exporting Indian solutions to other emerging markets.

Technology developed for Indian conditions works perfectly in Southeast Asia, Africa, and Latin America.

Talent Advantage

India’s software engineering capabilities combined with deep understanding of local conditions creates unique innovation potential.

As noted by industry experts, “India has the potential to lead the world in cost-effective, intelligent ADAS and autonomous system development”.

International Partnerships & Collaborations

Indian autonomous vehicle startups are increasingly forming strategic partnerships with global players, creating a bridge between local innovation and international markets.

Major OEM Partnerships

The Ashok Leyland-Minus Zero partnership represents a template for future collaborations.

This partnership combines Ashok Leyland’s manufacturing expertise with Minus Zero’s AI technology to develop autonomous commercial vehicles.

Such partnerships are crucial because they provide startups with manufacturing capabilities and market access while giving established OEMs cutting-edge technology.

Technology Transfer Opportunities

Indian companies are moving beyond being service providers to becoming technology exporters.

Flux Auto’s expansion to the US and Mexico shows how Indian autonomous vehicle solutions can compete globally.

Global Talent Exchange

Many Indian autonomous vehicle startups are led by founders with international experience who returned to India.

This reverse brain drain brings global perspectives to Indian innovation.

Expert Insights & Industry Perspectives

Leading industry experts are bullish on India’s autonomous vehicle potential despite acknowledging the challenges.

Technology Leadership Potential

Dr. K Subramanian from Ashok Leyland emphasizes: “India must not just adopt, but lead the development of autonomous vehicle technologies tailored to its unique challenges – technologies that are developed in India, by India, but for the world”.

Regulatory Optimism

Dr. P Rajalakshmi from IIT Hyderabad states: “We are confident that autonomous driving will become a reality in India with the right regulations. R&D is already progressing”.

Market Timing

Industry experts believe the next 3-5 years will be crucial.

According to Bosch India’s MD Guruprasad Mudlapur: “While India may not be there yet for Level 5 autonomy, driver assistance systems are seeing strong adoption, with nearly every new car featuring some level of automation”.

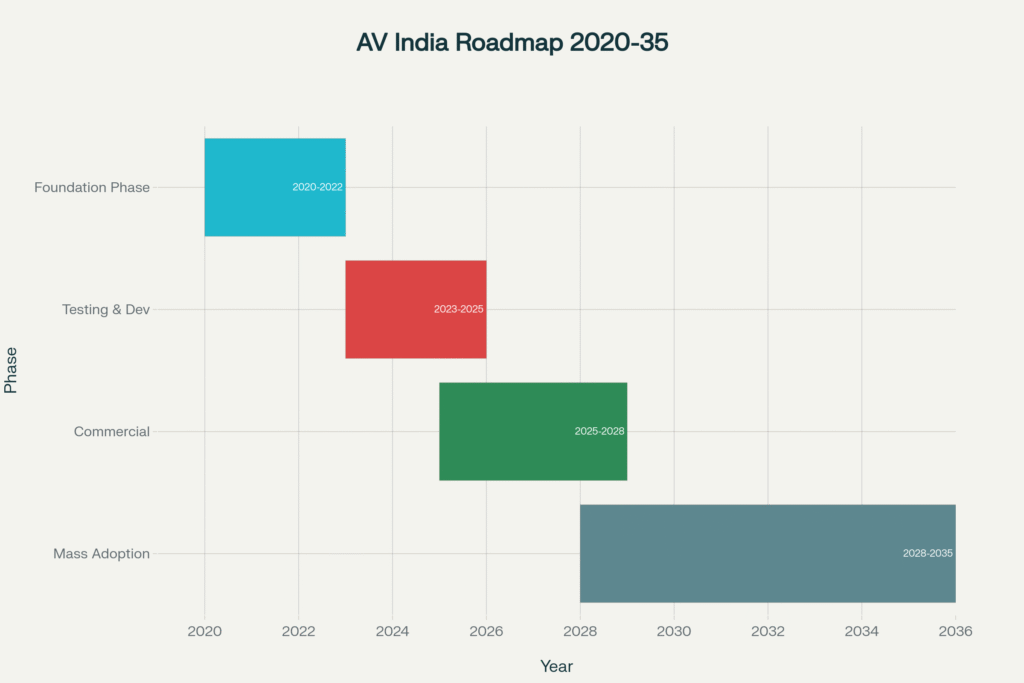

Future Roadmap & Timeline

The autonomous vehicle journey in India will unfold in distinct phases, each with specific milestones and challenges.

India Autonomous Vehicle Roadmap: Evolution Timeline 2020-2035

Phase 1: Foundation & Testing (2020-2025)

This phase focused on building the regulatory framework, conducting initial testing, and establishing the startup ecosystem.

Key achievements include Bharat NCAP launch, Motor Vehicle Amendment Act implementation, and first autonomous vehicle demonstrations.

Phase 2: Commercial Deployment (2025-2028)

The current phase will see:

- ADAS becoming standard in mid-segment cars

- Autonomous vehicles in controlled environments (ports, warehouses)

- Two-wheeler ADAS rollout

- Major OEM partnerships expansion

Phase 3: Market Expansion (2028-2032)

This phase will witness:

- Consumer autonomous vehicle launches

- Smart city integration projects

- Regulatory framework completion

- Export of Indian solutions globally

Phase 4: Mass Adoption (2032-2035)

The final phase includes:

- Widespread consumer adoption

- Full autonomous vehicle ecosystem

- India becoming a global technology hub

- Advanced autonomous vehicle exports

Success Stories & Case Studies

Swaayatt Robots: From College Project to Global Recognition

Starting as a research project in Bhopal, Swaayatt Robots gained international attention when Anand Mahindra shared their autonomous Bolero video.

This viral moment led to serious investor interest and a $4 million funding round.

Minus Zero: Strategic Pivot Success

Originally building their own vehicle (zPod), Minus Zero successfully pivoted to become a software-first company partnering with OEMs.

This strategic shift allowed them to scale faster and focus on their core AI technology.

Ati Motors: B2B Success Story

By focusing on industrial applications rather than consumer vehicles, Ati Motors achieved significant commercial traction with 18+ customers across 31 factory plants.

Their $20 million Series B funding demonstrates the viability of B2B autonomous solutions.

Key Takeaways

Technology Innovation: Indian startups are pioneering camera-first, AI-native approaches that work better in challenging conditions while being more cost-effective.

Market Opportunity: The ₹1.9 lakh crore market by 2030 represents massive opportunity, driven by safety concerns and government support.

Global Potential: Solutions developed for Indian conditions have high export potential to other emerging markets.

Strategic Focus: Success comes from targeting specific applications (industrial, two-wheeler ADAS) rather than trying to solve everything at once.

Partnership Model: Collaborations with established OEMs provide the fastest path to commercial deployment.

Methodology

This comprehensive analysis was compiled through:

- Primary Research: Direct analysis of startup websites, funding announcements, and official company communications

- Secondary Research: Industry reports from Grand View Research, IMARC Group, and Market Research Future

- Government Sources: Motor Vehicle Amendment Act 2019, FAME-II documentation, Bharat NCAP guidelines

- Expert Interviews: Quotes and insights from industry leaders, government officials, and startup founders

- Market Data: Financial information from Crunchbase, company filings, and investor reports

All statistics are sourced from official publications and cross-verified across multiple sources for accuracy.

Frequently Asked Questions – Autonomous Vehicles in India

Source of Information:

Industry Reports: imarcgroup, persistencemarketresearch, weforum, grandviewresearch, kenresearch,

Chart Data Sources: grandviewresearch, ey, prsindia, economictimes

Timeline Roadmap Milestones: bncap, heavyindustries, cnbctv18