Thinking about buying a new car? Confused about which brands Indians trust most? You’re not alone.

September 2025 brought some big surprises in India’s car market. The new GST 2.0 reforms and festive season completely changed the game. Some brands shot up like rockets, while others faced unexpected challenges.

This article gives you the complete picture – which car brands topped the charts, their best-selling models, and why buyers chose them. No technical jargon, just straight facts that help you make smart decisions.

India’s Car Market Snapshot – September 2025

September 2025 was historic for India’s passenger vehicle market. Total sales reached 2,99,369 units, showing 5.80% growth compared to August 2025.

The big game-changer? GST 2.0 reforms launched on September 22, 2025. This reduced car prices significantly, with some models getting price cuts up to ₹1.55 lakh. Combined with Navratri festivities, it created perfect buying conditions.

Key market highlights:

- Compact SUVs dominated the sales charts

- Electric vehicle sales nearly doubled for some brands

- CNG variants hit record numbers

- Export volumes reached all-time highs for several manufacturers

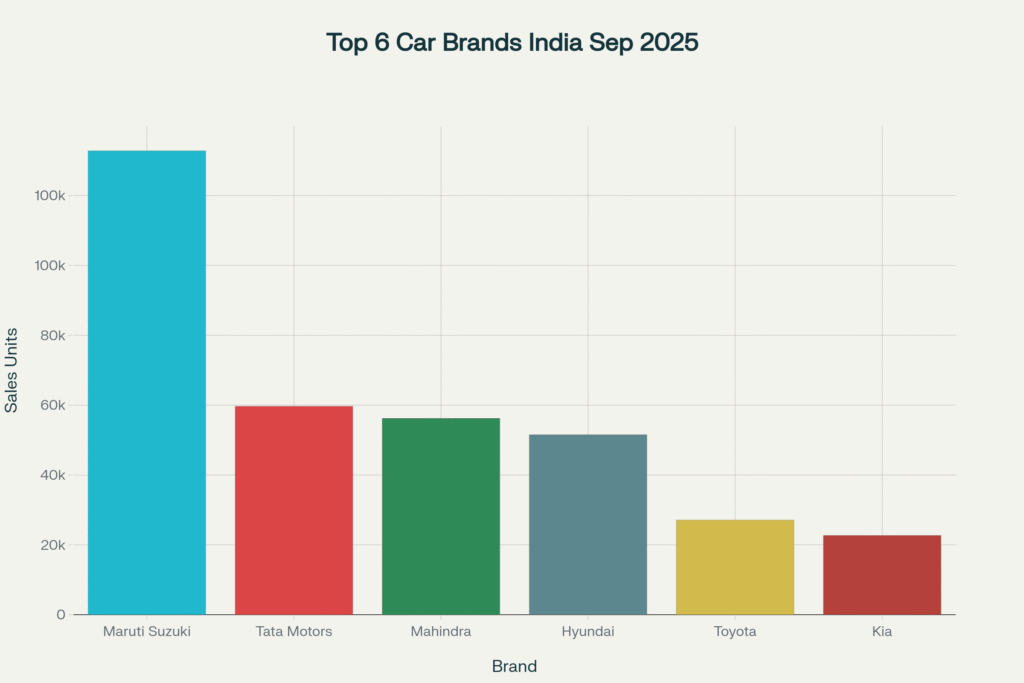

Top-Selling Car Brands in India – September 2025 Sales Volume

Top-Selling Car Brands in India – September 2025 (Complete Top 10 List)

Here’s the complete table view of India’s top 10 car brands for September 2025:

| Rank | Brand | September 2025 Sales | September 2024 Sales | YoY Growth % | Market Share % | Top Model | Segment Strength |

|---|---|---|---|---|---|---|---|

| 1 | Maruti Suzuki | 1,32,820 | 1,44,962 | -8.4% | 35.1% | Dzire (20,038) | Hatchbacks & Sedans |

| 2 | Tata Motors | 59,667 | 41,313 | +45.0% | 15.8% | Nexon (22,573) | Compact SUVs |

| 3 | Mahindra | 56,233 | 51,062 | +10.0% | 14.9% | Scorpio (18,372) | SUVs |

| 4 | Hyundai | 51,547 | 51,101 | +0.9% | 13.6% | Creta (18,861) | SUVs |

| 5 | Toyota | 27,089 | 23,802 | +14.0% | 7.2% | Innova Crysta | MPVs & Hybrids |

| 6 | Kia | 22,700 | 23,523 | -3.5% | 6.0% | Sonet (8,500) | Compact SUVs |

| 7 | Skoda | 6,636 | 3,302 | +101.0% | 1.8% | Kylaq | Premium Cars |

| 8 | MG Motor | 6,728 | 5,021 | +34.0% | 1.8% | Windsor EV | Electric Vehicles |

| 9 | Honda | 5,303 | 5,675 | -6.5% | 1.4% | City (2,350) | Sedans |

| 10 | Nissan | 1,652 | 2,113 | -22.0% | 0.4% | Magnite (1,652) | Entry SUVs |

Individual Star Performers

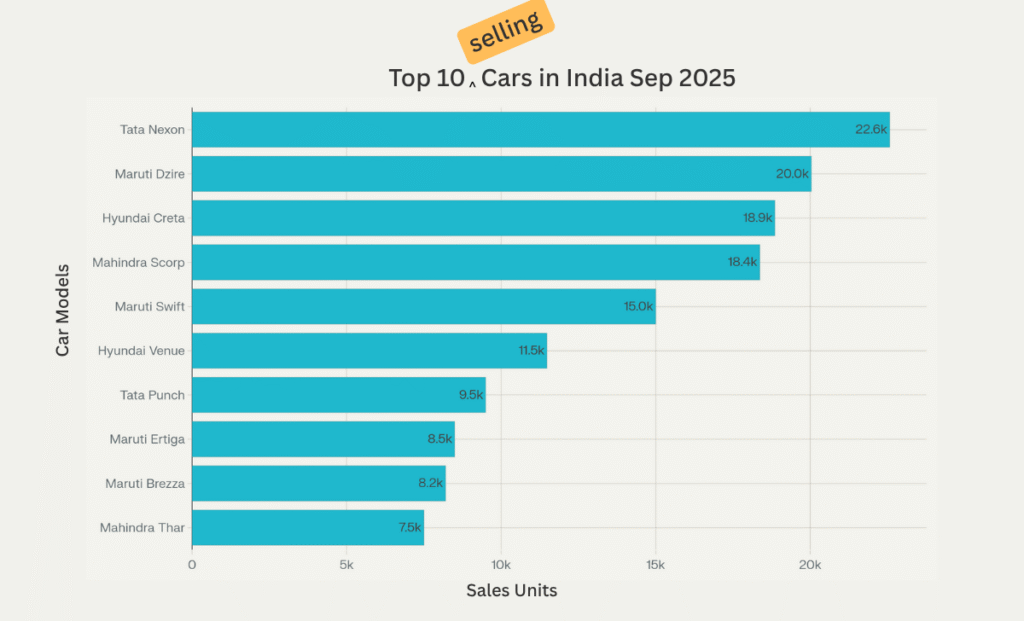

Tata Nexon – September’s Champion

The Tata Nexon became India’s best-selling car in September 2025. With 22,573 units sold, it beat all Maruti, Mahindra, and Hyundai models.

Why buyers love it:

- Multiple engine options (petrol, diesel, CNG, electric)

- 5-star safety rating

- Feature-loaded at competitive prices

- GST price cuts made it even more attractive

Hyundai Creta – Record Breaker

The Creta achieved its highest-ever monthly sales of 18,861 units. Despite being relatively old, it maintained strong demand in the mid-size SUV segment.

Maruti Dzire – Sedan King

The Dzire remained the top-selling sedan with 20,038 units. Its popularity in both personal and commercial segments (especially taxis) kept it strong

Top 10 Best-Selling Car Models in India – September 2025

Market Trends to Watch

Electric Vehicle Growth

Tata’s EV sales jumped 96% year-on-year to 9,191 units. This shows Indians are slowly accepting electric cars, especially in cities.

CNG Popularity

CNG variants hit record numbers across brands. With rising fuel costs, CNG offers a practical solution for cost-conscious buyers.

SUV Dominance

Compact and mid-size SUVs completely dominated sales charts. Even Hyundai achieved 72.4% SUV contribution to total sales.

Export Boom

Several brands hit export records. This shows Indian manufacturing quality is gaining global recognition.

Final Conclusion

September 2025 reshaped India’s car market rankings. Tata Motors emerged as the biggest winner, jumping to second position with record sales growth. The Nexon became India’s favorite car, beating all competitors.

Maruti Suzuki maintained leadership despite challenges, while Hyundai’s Creta set new records. Mahindra proved SUVs remain king in India’s market.

The GST 2.0 impact and festive buying created perfect conditions for growth. As we move toward Diwali 2025, expect these trends to continue.

For car buyers, this data shows Indian preferences clearly – affordable SUVs with good features, safety, and fuel efficiency win hearts and wallets.

What to watch in October 2025: Continued festive demand, inventory management challenges, and how brands sustain this momentum through Diwali season.